A sizable drain on inventories of commercial crude oil pointed to ongoing recovery in the U.S. economy, with increasing local prices likely to soon curtail oil exports, analysts told Zenger News.

The U.S. Energy Information Administration, part of the Energy Department, issues weekly data on Wednesday on inventory levels of crude oil and refined petroleum products such as gasoline and diesel, with decreases in the inventories usually indicating a strong economic appetite.

The agency reported this week that total commercial crude oil inventories declined by 7.6 million barrels. That puts crude oil inventories 6 percent below the five-year average for this time of year, suggesting a significant level of demand and possibly a supply-side issue.

For a similar week in 2019 — before the pandemic — the inventories were sitting about 7 percent above the five-year range.

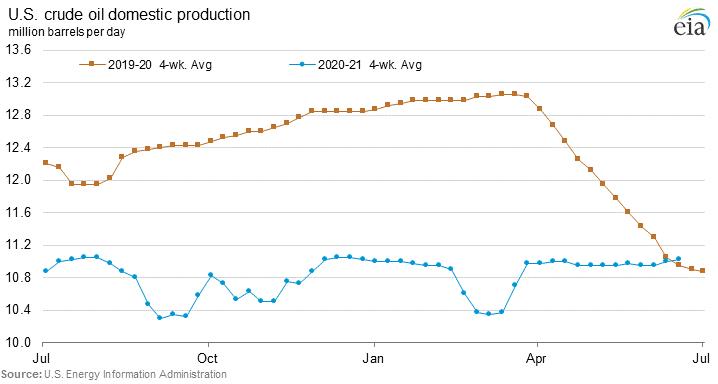

Ole Hanson, the head of commodity strategy at Saxo Bank in Denmark, told Zenger he was not surprised by the draw on inventories. U.S. crude oil production look to be about 2 million barrels a day below peak levels, with refiners still edging closer to running at full capacity.

“All in all, it’s due to U.S. production not shifting gear,” he said.

In the past, an increased production response to higher crude oil prices actually sent crude oil prices lower, hindering the bottom line for operators working in U.S. oil and gas basins.

Tamas Varga, an analyst at London oil broker PVM, said data points across the board were bullish for crude oil prices, which he said are flirting with multi-year highs on the back of dwindling supplies and growing demand.

“Let’s draw a line here and conclude that the report is positive,” Varga said.

Meanwhile, Energy Information Administration data support a perception that demand is at — or very close to — pre-pandemic levels. The total amount of refined petroleum products supplied to the market over the four-week period, which is a loose barometer for demand, averaged 19.5 million barrels per day, about 1.2 million barrels per day below the similar period in 2019.

Gasoline supplied to the market reached 9.1 million barrels per day over the latest four-week period — about 600,000 barrels per day below 2019 levels for this time of year.

Even with bullish metrics, the reaction in crude oil prices was muted. West Texas Intermediate, the U.S. benchmark for the price of oil, started the day up about 1 percent from the previous session, but cooled off later in the day to more or less even at around $73 per barrel.

Prices as they are could lower the incentive for U.S. crude oil exports.

Higher export levels helped drain on commercial crude oil inventories in recent weeks.

Giovanni Staunovo, a commodities analyst for Swiss bank UBS, said the diminishing difference, or spread, between the price of West Texas Intermediate oil and Brent crude oil, the global benchmark, was shrinking. Brent usually trades at a premium to the U.S. benchmark West Texas Intermediate, and the greater the premium, the more it encourages U.S. crude oil exports.

“If you add up transportation costs from the export terminal to the final destination and include the pipeline costs, if the spread is below $2 per barrel, it starts to become less attractive to export it to Asia,” Staunovo explained.

That could create headwinds for the ongoing rally in crude oil prices as lower exports would influence commercial crude oil inventories in the future. The spread between West Texas Intermediate and Brent on Wednesday was approximately $2.25 per barrel.

(Edited by Bryan Wilkes and Alex Willemyns)

The post US Petroleum Data Show Healthy Demand, Making Oil Exports Less Lucrative appeared first on Zenger News.