WASHINGTON — Whether it’s the fabrication of semiconductors or solar panels, mining of critical minerals, or even allegations of human-rights abuse, business and governments around the world are taking a hard look at their supply chains.

Changes are coming, with some industries feeling the most pressure to secure their materials, and corporations preparing for the impacts both in prices and taxes. Here’s what corporate executives should know about global supply chains and how they will have a larger impact on the economy.

Spurred by the supply chain issues that the COVID-19 pandemic presented — when the U.S. and other countries faced critical shortage of masks and other protective gear — U.S. President Joe Biden initiated a 100-day, government-wide review of supply chains and their vulnerabilities.

From China’s control of several critical minerals to South Korea’s advantage in semiconductors, the report lays out several areas where U.S. businesses and corporations face decided disadvantages due to supply chain disruptions. Overall, the American government’s review of the country’s supply chain has focused on four sectors: the defense industry, public health and pharmaceuticals, information and communications, and the energy sector.

Growing supply chain pressures on American firms

Every 3.5 years, companies can expect up to a month of production line delays due to supply-chain issues. That’s the conclusion from global management consultant McKinsey & Company in just one of several recent studies that show how vulnerable U.S. businesses and defense industries are to supply chain disruption.

The group’s research found 180 product categories where manufacturing was largely dominated by a single country. Meanwhile, 80 percent of global trade moves through countries with dropping World Bank political stability scores.

American firms often face more pressure to produce higher returns than Asian and European companies, which leads to increased demand for imported high-end manufacturing goods to U.S. shores.

“The result is longer U.S. supply chains and, in some cases, more opportunities for unpredictable events and disruptions,” the report said.

It’s not just about waiting for products, but also losing the edge on innovation. The administration’s report showed that the U.S. Department of Commerce that “ultimately, volume drives both innovation and operational learning; in the absence of the commercial volume, the United States will not be able to keep up with the technology, in terms of quality, cost or workforce.”

Semiconductors, solar, pharmaceuticals, and mining

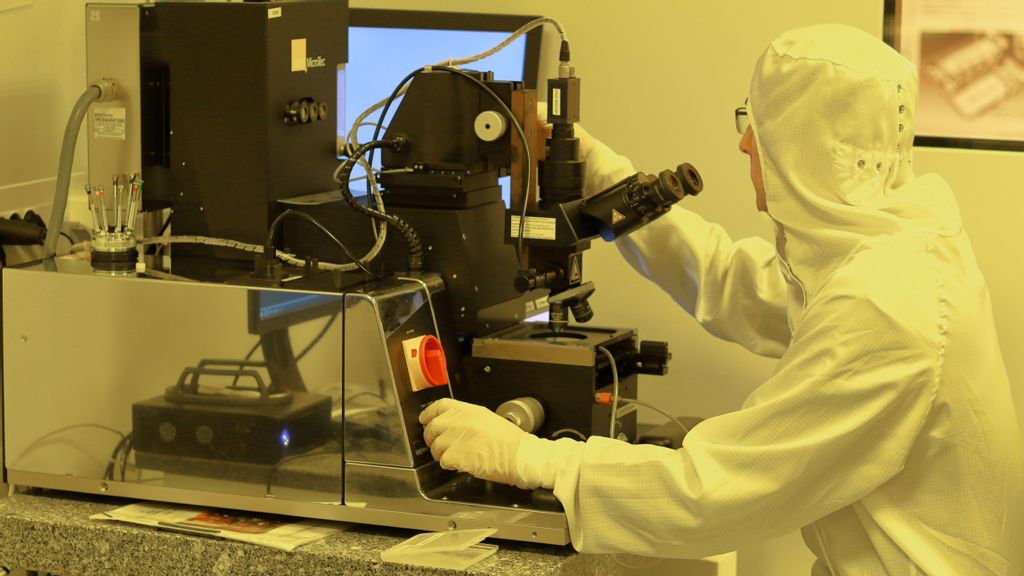

Semiconductor fabrication is another critical supply chain product whose overseas production represents a threat to American industry. These components are crucial in electronic devices, consumer products and automobiles.

The U.S. government’s supply chain report said that public investment has allowed Korea and Taiwanese semiconductor fabrication to outpace U.S. production. By building more semiconductors, these countries are set to take the lead in innovating the next generation of chips.

It’s not just the chips in your phone that are at risk. International accounting firm/business consultant PwC reported that just 2 percent of active pharmaceutical ingredients are manufactured in the U.S. And while rare earth metals like lithium and graphite are critical for high-capacity batteries, the Biden administration’s report estimated China controls 55 percent of global rare earths mining capacity and 85 percent of rare earths refining.

The problem is directly affecting some U.S. industries, including solar panels, analysts say. In its second-quarter report, the Solar Energy Industries Association said rising costs are due to higher material costs.

“There is a lag between commodity prices and subsequent solar-system prices. But there’s no doubt this is impacting the solar industry. Installers are managing current equipment shortages and having to decide whether to renegotiate contracts,” said Michelle Davis, principal analyst at researcher/consultancy Wood Mackenzie.

Taxes, incentives will guide corporate response

The United States is set to act on its fears of supply chain disruptions, and PwC said that the policies will likely focus on offering incentives to companies to move key manufacturing, mining and supply chain functions “onshore or nearshore.”

As PwC warns in its report on Biden’s review, changes in the supply chain can have “significant” tax implications, which could be either potentially good or bad. A supplier which is able to move production back onshore may see tax breaks that lead to lower prices. Companies that can’t, or won’t, make moves to shore up its supply chain may see increased taxes or fewer available deductions for production or production that can’t be sourced in the U.S.

Consultant McKinsey & Co. said organizations have generally applied two methods to tackle supply chain challenges. One is to rely on automation, artificial intelligence and other information-processing processes to identify risks. Another is to rely on experts to sort through the data and make assessments.

Effectively parsing and evaluating data is critical for organizations to understand their vulnerabilities and develop backup plans for supply chain delays, the report said, as supply-chain experts are able to balance cost and reliability with the uncertainty of geopolitics.

A link ahead in the chain

Several companies are taking proactive steps to ensure their customers and associates are aware of supply chain issues. Global mining concern Rio Tinto, the world’s second-largest metals and mining corporation, is launching a new product to help its customers understand the supply chain behind the products it delivers, company general manager Paramita Das told the Bipartisan Policy Center. Called Sustainability, Traceability Assurance from Rio Tinto, it is “essentially the nutrition label of our product,” she said.

“‘We are bringing complete transparency to our supply chain. It’s critical in today’s world,” Das said.

Edited by Matthew B. Hall and Bryan Wilkes

The post Fixing Supply-Chain Snags A Top Priority In Several U.S. Sectors appeared first on Zenger News.